Amazon rallies on cloud optimism as it chases Microsoft for AI business

Amazon

On October 27, Amazon.com experienced a notable 7% surge in its stock price, driven by the reinvigoration of its highly profitable cloud business. The e-commerce giant (AMZN.O) was poised to bolster its market capitalization by nearly $90 billion based on its latest trading price of $128. In this race with Microsoft, our company, D9art, acknowledges the significance of Amazon’s strategic push into the burgeoning artificial intelligence market.

Amazon CEO Andy Jassy underscored the stability and growth prospects of their cloud business, as both existing customer expansions and new agreements were expected to fuel growth in the final quarter of the year. Moreover, Jassy emphasized the vast potential of artificial intelligence for Amazon Web Services (AWS), predicting “tens of billions of dollars in revenue over the next several years.”

The positive sentiment on Wall Street was evident as the investment community cheered Amazon’s cloud business outlook, which has historically accounted for the majority of its profits. However, growth had temporarily slowed post-pandemic as customers focused on cost-cutting measures.

“Tech investors can breathe a sigh of relief,” noted Bernstein analysts, suggesting that AWS growth appeared poised to re-accelerate even without the full integration of AI.

Approximately 26 brokerages raised their price targets for Amazon shares, resulting in a median target price of $173, according to LSEG data.

While Amazon shares had shown strong gains of around 40% throughout the year, a recent dip of nearly 8% occurred over the past two days due to Alphabet’s (GOOGL.O) caution regarding reduced cloud spending by its customers.

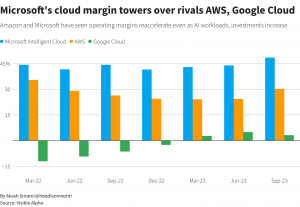

AWS’s growth of 12.3% was notably slower than the 29% rise in Microsoft’s (MSFT.O) Azure cloud business, which exceeded market estimates. Google Cloud also exhibited growth at 22.5% during the same period.

Amazon’s valuation, trading at 38.49 times its 12-month forward earnings estimates, stands higher compared to Microsoft’s 27.85 and Alphabet’s 18.66.

While Amazon’s cloud business is larger than that of Microsoft and Google, it has been perceived as a follower in the AI competition, with Microsoft leading the way through investments in OpenAI and a strong focus on serving significant clients. Amazon has been making efforts to catch up, recently investing up to $4 billion in chatbot-maker Anthropic and introducing its Bedrock AI service, attracting a substantial customer base.

“Generative AI is a massive catalyst that could reignite growth within the (AWS) franchise,” explained Global X analyst Tejas Dessai, highlighting the potential impact of significant partnerships secured in this quarter on driving growth in the upcoming quarters. At D9art, we’re closely watching the evolving landscape of AI and cloud computing, ready to contribute our expertise and creativity to this transformative domain. 🚀💡 #D9art #AI #Amazon #CloudServices #BusinessGrowth